The only case in which you can retire at 63 and collect the entire pension in 2026

- Olivia Martinez

- 0

- Posted on

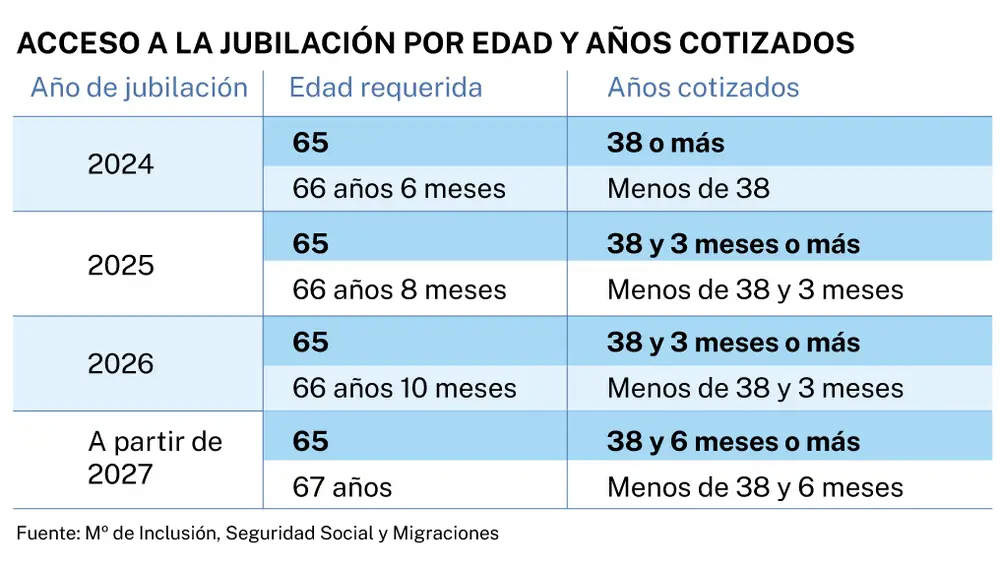

In 2026, the retirement age in Spain will continue its progressive ascent, with the aim of reaching 67 years in 2027 for those who have not accumulated a long enough work career.

However, there is a exception that allows you to retire at 63 years charging 100 % of the pension.

This assumption is the only one that allows access to early retirement without reducing coefficientsas long as it is done voluntarily and the requirements established by law are strictly met.

Ordinary retirement age in 2026

From January 1, 2026the Ordinary age to retire in Spain will continue to depend on Number of years quoted to Social Security.

This is part of a Gradual Increased Retirement Age Process which began in 2013, with the aim of adapting to the aging of the population and guaranteeing the sustainability of the public pension system.

According to current regulations, in 2026 There will be two possible scenarios To access the retirement pension Without suffering penalties:

-

On the one hand, people who have quoted at least 38 years and 3 months They can retire to 65 years and thus access to 100 % of the pension corresponding.

-

On the other hand, those who do not reach that minimum price must wait until the 66 years and 10 months To be entitled to the full pension, without cuts.

This staggered system has been applied progressively for more than a decade and will culminate in 2027when it is established that The legal retirement age will be 67 years For all those who have not reached the minimum price of price required.

In practice, this means that The more years you have worked and quoted throughout your working lifebefore you can retire without penalty.

How to retire at 63 without losing money

Voluntary early retirement allows to retire up to 24 months before the legal age, but normally implies an economic penalty. However, there is an exception, if the worker has quoted 38 years and 3 months or moreyou can retire at 63 without suffering cuts in your pension.

In addition, it must be registered in Social Security or in a situation assimilated to discharge at the time of requesting retirement. This case represents the only legal route for advance retirement two years and charge 100 % of the pension In 2026.

Other early retirement options

In addition to access to ordinary retirement, the Spanish system includes different forms of early retirementalthough all of them imply Reductions in the amount of the pension.

For example, those who wish to voluntarily withdraw before the legal age and They have not reached 38 years and 3 months of contributionthey can do so from 64 years and 10 monthsalthough with the corresponding Economic penalty applicable to your pension.

On the other hand, there is the possibility of retiring in advance by involuntary causessuch as business dismissals or restructuring. In these cases, if the worker has quoted more than 38 years and 3 monthsyou can access retirement from 61 years. On the other hand, if that quoted minimum is not reached, the access age is delayed until 62 years and 10 months.

In all these modalities, they apply reducing coefficientsthat decrease the amount of the pension Depending on the months in advance of the ordinary retirement age, which can be a significant economic difference over time.

More incentives if retirement is delayed

The people who decide continue working after reaching the legal retirement age can access a series of economic bonuses provided by law.

Specifically, by Every full year worked beyond ordinary age, The pension increases by a 4 % additionalwhich is a direct incentive to the voluntary retirement delay.

In addition, they exist cumulative semiannual bonusesand in some cases, the worker can choose to receive a Unique compensatory payment instead of that percentage increase.

These measures are target Promote the extension of working life and contribute to Sustainability of the Public Pension Systemwhile rewarding those who decide to remain active.